JudeEsq

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s.

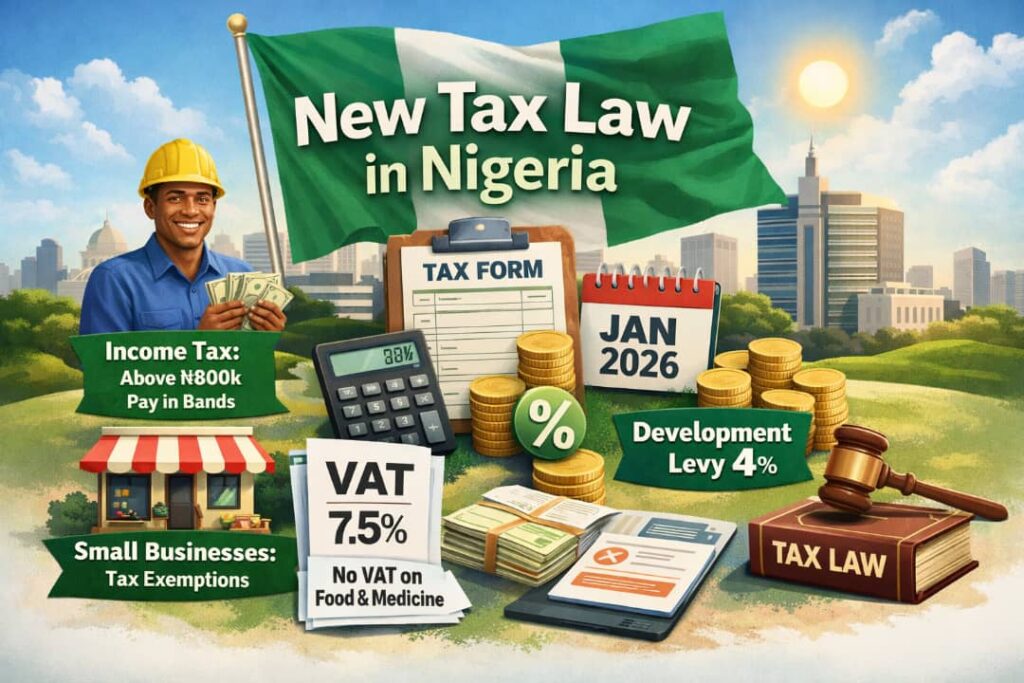

Nigeria is implementing a major reform of its tax system starting January 1, 2026. This reform is the biggest change to the nation’s tax rules in decades and aims to modernize how taxes are collected and who pays them. The changes have sparked debate across the country. Some Nigerians are upset or confused, while others see positive reforms. This post explains the key points clearly and accurately.

Why the Reform Matters

President Bola Tinubu’s government has said the new tax law is necessary to improve how Nigeria raises revenue and to strengthen the economy. The government has faced criticism and controversy around the rollout of the reforms. Some lawmakers argue that parts of the law changed after passage and that those changes were not properly authorized. Critics also worry about the economic impact, while the government defends the reforms as essential for long term fiscal stability. Reuters reports that, despite calls for delay, the government is moving ahead with implementation.

What the New Law Is

The reform is not a single law. Instead, four major tax acts were signed in 2025 and will all come into effect from January 1, 2026. These laws work together to replace older tax rules and create a unified, modern tax system. The key acts include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Act, and the Joint Revenue Board Establishment Act.

Key Changes for Individuals

New Personal Income Tax Structure

Under the new rules, individuals earning eight hundred thousand naira (₦800,000) or less per year are completely exempt from personal income tax. Progressive tax bands apply to higher income levels, reaching a maximum of 25 percent for the highest earners. This is intended to protect low income earners while asking higher earners to contribute more.

Rent Relief and Deductions

The law introduces new tax relief measures, including the ability for salaried workers to deduct up to two hundred thousand naira (₦200,000) in annual rent from taxable income. The law also simplifies filing for people earning mainly salary by providing an automatic, simplified filing scheme for those earning under five million naira per year.

Unified Taxpayer Identification Number

All taxable individuals will now be required to have a Unified Taxpayer Identification Number, or UTIN. This number will be used across different tax types and is part of the effort to make the system more coordinated and easier to administer.

Key Changes for Businesses

Small Business Exemptions

Small businesses are given significant relief. Companies with an annual turnover of up to one hundred million naira and total fixed assets of two hundred fifty million naira or less are now exempt from Companies Income Tax, Capital Gains Tax, and the new Development Levy. This change is aimed at reducing the compliance burden on small enterprises.

Corporate Tax Rate and Development Levy

The corporate income tax rate for larger companies is now reduced from 30 percent to 25 percent. In addition, a new 4 percent Development Levy applies to the assessable profits of businesses that do not qualify as small companies. This levy replaces several overlapping levies that existed previously, making the system simpler.

Minimum Effective Tax for Large Multinationals

To prevent tax avoidance, large companies, especially multinational enterprises, are subject to a minimum effective tax rate. If a company or group with global revenues above certain thresholds pays less than 15 percent in net tax, the law will require a top up to reach that level. This aligns Nigeria with global tax norms.

Capital Gains and Digital Economy Taxation

Capital Gains Tax for companies is increased to 30 percent, aligning it with the standard corporate income tax. The reform also expands what is considered taxable, including digital and virtual assets under certain conditions. Exemptions for low value gains, private residences, and reinvested gains help protect ordinary taxpayers.

VAT and Technology Enhancements

Nigeria retains the value added tax rate at 7.5 percent. However, the law strengthens how VAT is administered. Essential goods and services, such as healthcare, food, and education materials, are zero rated, meaning no VAT applies. The law also requires businesses to adopt electronic invoicing and real time reporting systems to improve compliance and reduce evasion.

Administration and Dispute Resolution

The new Nigeria Revenue Service replaces the old Federal Inland Revenue Service, creating a more centralized tax authority. Inter agency efforts are coordinated through a Joint Tax Board, and new structures are put in place to help resolve taxpayer disputes more efficiently.

What This Means for You

For many ordinary Nigerians earning modest incomes, the new tax law offers clear tax exemptions and reliefs that could improve take home pay. For medium and larger businesses, the system is modernized and designed to promote compliance and investment. For the government, the aim is to broaden the tax base and increase revenue in a way that is more efficient and transparent.

At the same time, the rollout has been controversial, and many citizens have raised questions about communication and clarity. Those concerns are part of a healthy democratic discussion on how tax revenue is used and how citizens should be involved in fiscal policy.

Advice for Businesses

- Update Your Records and Registration

Ensure your business has a Unified Taxpayer Identification Number (UTIN). All taxable entities must use it across all tax filings. This avoids errors and penalties. - Understand the New Corporate Rates

- Small companies may be fully exempt from Companies Income Tax, Capital Gains Tax, and the Development Levy.

- Larger companies should adjust accounting and budgeting for the new 25 percent corporate tax and the 4 percent Development Levy.

- Plan for Compliance

Use electronic invoicing and real time reporting systems as required by the law. Proper compliance reduces fines and improves transparency with tax authorities. - Seek Expert Guidance

The law has nuanced provisions for multinational operations, digital income, and capital gains. A qualified tax consultant or legal advisor can help you avoid mistakes and optimize exemptions.

Advice for Employees

- Check Your Tax Bracket

Individuals earning eight hundred thousand naira (₦800,000) or less per year are fully exempt from personal income tax. Higher earners should confirm their taxable income and calculate contributions accurately. - Use Available Reliefs

Salaried employees can deduct up to two hundred thousand naira in annual rent from taxable income. Make sure your HR or payroll systems reflect these deductions. - Verify Payroll Compliance

Ensure that your employer is withholding the correct tax amounts and using your UTIN properly. Mistakes can cost you money or create issues with the tax authorities later. - Stay Informed

Understand the rules for bonuses, allowances, and other income, especially if you have multiple income streams. Being informed protects you and ensures you don’t overpay.

Advice for Individuals

- Get Your UTIN

Even if you are exempt, having a Unified Taxpayer Identification Number is essential if your income rises above the exemption threshold in the future. - Keep Records

Save receipts for rent, investments, and other deductible expenses. These can help reduce your taxable income and prove claims if needed. - Understand Digital Income Tax

Income from online platforms, freelancing, or virtual assets may now be taxable. Track and report these earnings accurately. - Ask Questions and Seek Clarity

If something is unclear, contact your tax office or a professional advisor before assuming anything. Being proactive prevents problems later.

Bottom Line:

- Businesses: comply, plan, and seek guidance.

- Employees: know your exemptions, deductions, and verify payroll.

- Individuals: stay informed, track income, and be proactive with records and UTIN.

Nigeria’s new tax law is valid, but clarity and preparation are key to making it work for you instead of against you.

Conclusion

Nigeria’s new tax law, taking effect from January 1, 2026, is a landmark reform. It changes how individuals and businesses are taxed, introduces new incentives and reliefs, and modernizes tax administration. While it aims to make the system fairer and more efficient, it also highlights the need for clear communication and accountability from authorities.